So, you’ve probably heard about Fifth Third Bank internet banking, right? Well, let me tell ya, this ain’t just some fancy online tool—it’s a game-changer for anyone looking to manage their finances with ease. Whether you’re a tech-savvy millennial or someone who’s still getting used to smartphones, Fifth Third Bank’s internet banking platform is designed to simplify your life. Imagine having your bank right at your fingertips, ready to help you pay bills, transfer funds, and track expenses without ever stepping into a branch. Sounds pretty sweet, huh?

In today’s fast-paced world, managing finances shouldn’t feel like a hassle. That’s where Fifth Third Bank internet banking comes in. It’s not just about convenience; it’s about giving you control over your money. From setting up automatic payments to monitoring your account activity in real-time, this platform offers features that cater to both beginners and seasoned users. And guess what? You don’t need to be a financial guru to figure it out!

But hold up—before we dive deep into the nitty-gritty, let’s break down why Fifth Third Bank internet banking is worth your time. Sure, there are tons of online banking options out there, but this one stands out for its user-friendly interface, robust security measures, and customer support that actually gets things done. In this article, we’ll walk you through everything you need to know, from setting up your account to maximizing its features. So, buckle up and let’s get started!

Read also:Susan Kellermann The Untold Story Of A Remarkable Life

What is Fifth Third Bank Internet Banking?

Alright, let’s get straight to it. Fifth Third Bank internet banking is basically an online platform that allows you to access and manage your accounts from anywhere, anytime. Think of it as your virtual bank teller, but way cooler. With this service, you can perform a wide range of transactions without ever leaving your couch. Need to pay a bill? Done. Want to transfer money to a friend? Easy peasy. Need to check your balance? Just a few clicks away.

Key Features of Fifth Third Bank Internet Banking

Now, here’s where it gets interesting. Fifth Third Bank’s internet banking isn’t just about checking your balance. It’s packed with features that make banking a breeze. Let’s break ‘em down:

- Bill Pay: Say goodbye to late fees. Schedule payments for rent, utilities, or even your Netflix subscription.

- Account Transfers: Move money between your accounts or send funds to someone else—all from the comfort of your home.

- Transaction History: Keep track of every penny you spend with detailed transaction records.

- Alerts and Notifications: Get notified when your account balance dips below a certain amount or when a payment is due.

- Mobile Compatibility: Access your accounts on the go using the Fifth Third Bank mobile app.

How to Sign Up for Fifth Third Bank Internet Banking

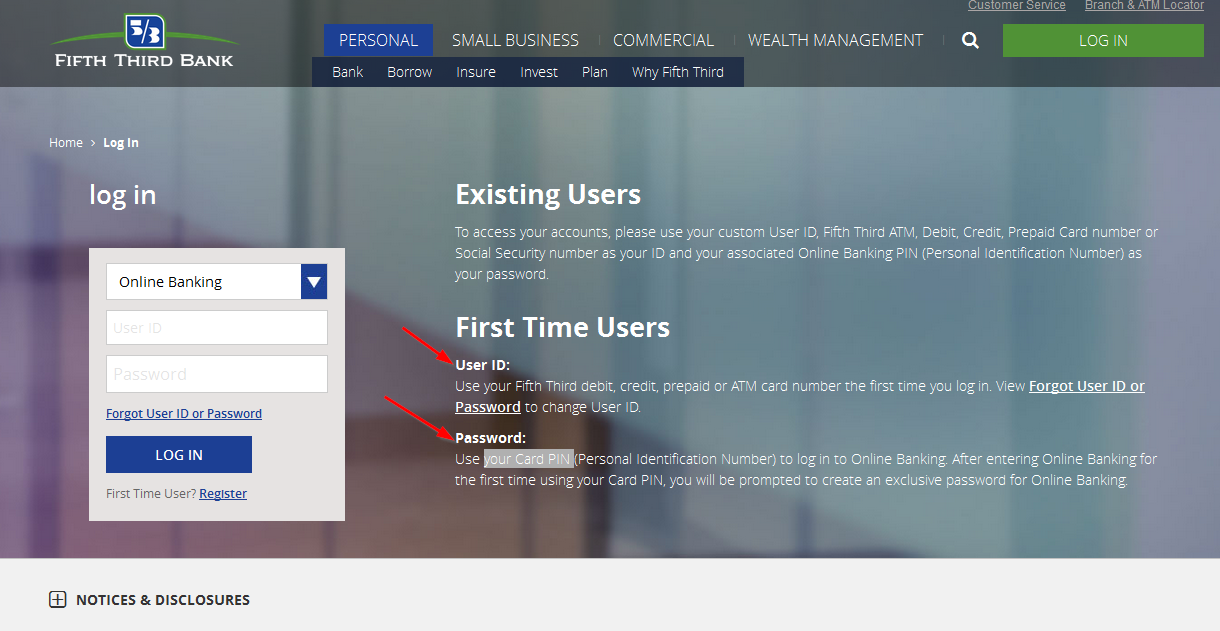

Signing up for Fifth Third Bank internet banking is a piece of cake. Here’s a step-by-step guide to get you started:

- Head over to the Fifth Third Bank website and click on the “Sign Up” button.

- Enter your account information, including your account number and Social Security number.

- Create a username and password. Make sure they’re strong enough to keep those pesky hackers at bay.

- Verify your identity by answering a few security questions.

- Boom! You’re all set. Welcome to the world of online banking.

Pro tip: Write down your login details in a secure place. Trust me, you’ll thank yourself later when you inevitably forget your password.

Is Fifth Third Bank Internet Banking Secure?

Security is a big deal, and Fifth Third Bank gets it. They’ve got a bunch of measures in place to keep your info safe. From encryption technology to two-factor authentication, they’ve got your back. Plus, their fraud monitoring system keeps an eye out for suspicious activity, so you can sleep soundly knowing your money’s protected.

Best Practices for Staying Safe

Even with all the fancy security features, it’s still up to you to stay vigilant. Here are a few tips:

Read also:What Does Cameron Diaz Husband Do Exploring The Career Of Benji Madden

- Use a strong, unique password and change it regularly.

- Avoid using public Wi-Fi for sensitive transactions.

- Enable multi-factor authentication for an extra layer of protection.

- Monitor your accounts regularly for any unauthorized activity.

Remember, safety first!

How to Navigate Fifth Third Bank Internet Banking

Once you’ve signed up, it’s time to explore the platform. Here’s a quick rundown of what you’ll find:

Dashboard Overview

Your dashboard is like the control center of your financial life. From here, you can see your account balances, recent transactions, and any upcoming bills. It’s all neatly organized, so you don’t have to dig through a bunch of clutter to find what you need.

Managing Transactions

Need to make a payment or transfer funds? No problem. Just click on the relevant tab, enter the necessary info, and hit submit. It’s as simple as that. Plus, you can schedule recurring payments, so you never miss a deadline.

Maximizing Fifth Third Bank Internet Banking Features

Now that you know the basics, let’s talk about how to get the most out of Fifth Third Bank internet banking. Here are a few ideas:

- Set Up Alerts: Get notified about important account activity, like low balances or large transactions.

- Use the Mobile App: Access your accounts on the go and take advantage of features like mobile check deposit.

- Explore Budgeting Tools: Track your spending habits and set financial goals with built-in budgeting tools.

- Utilize eStatements: Go paperless and receive your bank statements electronically.

These features aren’t just bells and whistles—they’re designed to help you take control of your finances. So, don’t be afraid to experiment and find what works best for you.

Common Issues and Troubleshooting

Let’s face it—sometimes things don’t go as planned. If you run into any issues with Fifth Third Bank internet banking, don’t panic. Here are a few common problems and how to fix them:

Forgot Password?

It happens to the best of us. To reset your password, click on the “Forgot Password” link on the login page. Follow the prompts to verify your identity and create a new password.

Can’t Access Your Account

If you’re having trouble logging in, double-check your username and password. If that doesn’t work, try clearing your browser cache or using a different device. Still stuck? Give Fifth Third Bank’s customer service a call—they’re happy to help.

Customer Support: Your Safety Net

One of the coolest things about Fifth Third Bank internet banking is their customer support. Whether you need help with a technical issue or have a question about your account, their team is ready to assist. You can reach them via phone, email, or live chat. Plus, they’ve got a ton of resources on their website, including FAQs and video tutorials.

How to Contact Support

Here’s how to get in touch with Fifth Third Bank’s customer support:

- Call their customer service hotline at [insert number].

- Send an email to their support team at [insert email].

- Chat with a representative directly through the Fifth Third Bank website.

No matter which method you choose, you’ll get prompt and friendly assistance.

Benefits of Using Fifth Third Bank Internet Banking

Still on the fence about signing up? Here’s why you should give Fifth Third Bank internet banking a shot:

- Convenience: Access your accounts anytime, anywhere.

- Security: Peace of mind knowing your info is protected.

- Cost Savings: Avoid late fees and save time by managing everything online.

- Customization: Tailor the platform to fit your needs with personalized settings.

At the end of the day, Fifth Third Bank internet banking makes your life easier. And who doesn’t want that?

Conclusion: Take the Leap and Simplify Your Finances

So, there you have it—everything you need to know about Fifth Third Bank internet banking. From signing up to troubleshooting, we’ve covered it all. This platform isn’t just a tool; it’s a partner in your financial journey. With its user-friendly interface, robust security features, and helpful customer support, it’s no wonder so many people are making the switch.

Now, here’s the million-dollar question: Are you ready to take the leap? If the answer’s yes, head over to the Fifth Third Bank website and get started. And don’t forget to share this article with your friends and family—knowledge is power, after all.

Table of Contents

- What is Fifth Third Bank Internet Banking?

- Key Features of Fifth Third Bank Internet Banking

- How to Sign Up for Fifth Third Bank Internet Banking

- Is Fifth Third Bank Internet Banking Secure?

- Best Practices for Staying Safe

- How to Navigate Fifth Third Bank Internet Banking

- Maximizing Fifth Third Bank Internet Banking Features

- Common Issues and Troubleshooting

- Customer Support: Your Safety Net

- Benefits of Using Fifth Third Bank Internet Banking